LUX ANT DIGITALBANK

By providing the Lux Bank Digital Ant platform as an electronic bank, you can build close relationships with customers, suppliers, and families. Controlling the experience of purchasing, selling, transferring, and / or transferring digital assets from sign-in to the end of the transaction. Digital Digital LUX is integrated into the customer's operational experience to enable customers to use the credentials typically used to identify and trade Web sites. To be able to.

In all these cases we add a low cost transaction fee from traditional banks.

Provide third party workers in the deal. ANTILUX Digital

Smart contracts are applied when a broker does not exist, which reduces service costs. Similar to other services, pre-qualified microfinance posting

Use Smart Contract to find customers with one click on request. This makes it convenient and cost-effective to reduce the cost of each loan required.

An application that manages funds (using your biometrics and modules to collect third-party APIs) Lux Ant Digital wants to advance its product and service network a step further. With APP, all registered users can use it to perform any type of operation. Users with identification problems can log in using protocol checking. With APP Alux Bank, you can negotiate such as remittance, savings, receipt of a roster or other payment, currency exchange, etc.

Online and micro-loan requests, and other social networking portals that can only be accessed by Alux Bank's customers at the same APP. The portal mentioned earlier allows all users who need to create a publication.

We made the opportunity to create our own profile

Interact with others. However, you can also create a profile for private cases that you do not want to interfere with your social network.

The payment card is completely secure.

Innovative card payments make it easier to design your cards. This operation works without the need for chips and / or pins using a simple QR code that connects directly to your bank account. The efficiency is based on the card without the GO registering the Alux Bank and making it easy to remove from the account, simple movements allow the extraction of cash in the future, as well as a small amount of payment or outstanding transactions related to the central bank it QR code In the event of a lost or stolen card, it is as simple as entering an online platform and canceling a lost or stolen card.

Your company's Alux Bank card collaborators are not only requested through APP, but are also available to all merchants.

A remittance service with at least a commission fee

Maximum speed without intermediaries.

The remittance method is used every day because many people do not have bank accounts and can use the services mentioned above. Who uses the money transfer service?

• People who need to send or receive money quickly and safely.

• People who helped relatives or friends.

• Emergency tourists.

• A business person who sends or receives money quickly for work.

• A person who wants to send gifts in cash.

Traditional methods require identification when collecting money.

Given the limitations of international transfers and the limitations of cash extraction, they should be extracted in cash. Through this process, anyone waiting to receive the money should be able to use the money that was sent for lack of traffic.

At Alux Bank, we are able to perform tasks with a maximum rate and minimum fees without a person in the world, and smart contracts will make changes quickly and easily without intermediaries, and our platform will automatically convert our platform to penting.Metode does not geographically position itself Forget the height that gives you the possibility to receive the money without.

security.

Worldwide physical ATM

Lux Ant Digital wants to implement an ATM cashier network around the world.

The functions of cashier are as follows.

• Encryption for calls or cryptocurrency conversion to BitKey

Requested Attorney.

• To perform previous and reverse services

Ethereum or Bitcoin currency conversion

• Provide cash and receive FIAT from APP Alux Bank.

• To run the old and reverse services

Get FIAT conversion and immediate cash.

• Recharge the Alux Bank card using the cashier.

(Such as cigarette handling, newspaper kiosks, shopping centers, etc.) .Gagasan is a collaborator for the growth of the Alux banking network, which will be for the issuance of mereka.Visi card and charging experts The contract with the company focuses on shopping center chain stores, streets, all countries, bookstores, gas stations, cabins and how to facilitate its use. This will help you get closer to your users.

Secure micro loans

When we present the Digital Lux Ant platform as electronic finance,

Sell transaksi.Lux digital ant clients can use their credentials in the habit of using and starting relationships with customers, suppliers and relatives, sending money and / or digital assets from the beginning of the session until the end To control the experience of buying, identify and conduct transactions on the web. For all of this, we will charge a minimal fee for the work. Lux digital ant, we are smart in this way to reduce the cost of services that we have designed this way by using micro Kontrak.Ini we designed a micro-loan release based on previous feasibility studies for every request client it in a single click The contract is to implement a cheaper rate for the benefit and ensure comfort and convenience.

Facility cost.

How to use it

Users / clients that pass the biometric level and are uploaded / integrated to the Alux Bank platform. Users who do not want to participate in the portal can decide to make their profile private or public at a particular moment. As mentioned earlier, the item reflects all other publications of the user. The launch of a new venture company for new business or expansion, micro-loan requests from individuals or companies, etc. The publication will relate to new investment and micro-loan requests. Depending on the profile of each user, the requirements type or requirements,

MICRO-REQUESTED QUALITY

Profiles, on the other hand, will be interested in helping and collaborating. This includes the request. This is one way you want to provide capital to other users so that they can continue to borrow or invest in some published projects. Intelligent agreements are integrated into the Alux Bank platform.

The loan profile will continue to receive direct requests from plaintiffs without brokers, and will help to reduce administrative costs and improve processes thanks to the quick response of commercial contracts. At the end of the request,

Repayment of loans specified in the agreement and the specified margin

His interest and.

Cooperation with financial organizations

Lux Ant Digital provides integrated facilities to public officials by linking parts of the project to work with financial institutions. Our approach to working with the central bank and supporting additional digital coins will be a major goal of financial and economic integration and social cohesion as we support a much larger microeconomics and at the same time we can improve, We will be able to provide the financial institutions mentioned above,

Systems and infrastructure for integrating or issuing digital coins, and products that enable customers to interact with currency in a variety of ways. Finally, the information we collect from the central bank of our platform provides the information we need to manage and manage the systems mentioned in the event.

There is more than one-third of the world's population unable to use official financial services. Most are entering developing countries in sub-Saharan Africa, the Middle East, East Asia and the Pacific. Inadequate financial infrastructure, financial service costs and distance between branches, identity verification, low incomes and literacy rates, frequent civil war and war are all factors that contribute to the low level presence of major metropolitan branches in these countries. A great opportunity to solve problems without a banking system. The country with the highest percentage of the population

Economic growth is fastest.

African middle class cases have tripled over the last 30 years and now more than 300 million. The general cost of goods and services in African countries has increased to about $ 860 billion in 2008 and is expected to increase to $ 1.4 trillion by 2020. This is a tremendous opportunity for all relevant areas. (For example, if we are allowed access to international capital, Africa can grow faster than it is now.

In the same way, offshore companies are entitled to do business with many people who have not really been exposed to foreign products and financial services so far. By ensuring that many people are isolated from the international capital, they provide many opportunities for these people as well as the international community.

This growth is fast, but continues to suffer from lack of access to formal financial services.

People who start their own business or start saving for example

Can not get money, credit or savings account. If you do not have an industrial bank, you can prevent money from being sent, and in many cases the real existence of two colleagues is required. There are also various projects that promise the cryptocurrency itself. The cryptocurrency itself is useful, but has the disadvantage of high price volatility.

Ethereum's Smart Contract network provides a simple transport of values. They can be transported to places at very low cost. You do not need to identify the bank and you need the bank's infrastructure. You need a smartphone that can access the internet to send money to the continents and all over the world.

cryptocurrency, they are various projects

It was built on them. One is that the product is still accessible to people who are outside the control of the economy, so the password is useful currency, but they have some disadvantages, such as the high volatility of the customer harga.Memahami problem without the bank account, The function is growing.

Simple face recognition and / or speech recognition systems provide authentication methods for people who do not have identification documents. In addition, the already created igaliter token discharge system enables familiar acquisitions with low-income countries.

Our Goal for Developing Countries

• To reduce poverty.

• Provides the possibility to provide jobs for distance and economic growth.

Increase savings and lending capacity.

• Innovation and infrastructure: e-finance creates new financial services

Business and Products.

• Minimize class inequality.

• Establish genre equivalence to encourage financial electronics

Activities for women control their own funds and business.

• Improve the quality of education through direct access

Ability to pay.

The previous aspect will affect the improvement.

Sender

• The economic situation in the third world countries can reduce immigration especially facing the developed countries in the European Union (EU) created from high cost due to social welfare system problems.

• Unwanted, with people who use this day, with a large number of traders and markets, the business delas will attract more companies on the continent that will have more doors for themselves if they are not exposed to almost any foreign financial products and services.

Alux Bank is not a welfare or charity organization, but it is committed to providing an ideal solution.

In order to get people from the economically high ground to participate in the new digital economy, they can help build their build / change their lives, it is already opening the door for the niche market everyone has already developed.

Lux Ant Digital has devised two strategies for monetizing

Passive.

Active Model:

• Token personal development.

• Self-trading robots.

We manufacture ATMs with personalized software.

• Storage of the most secure and transparent digital assets.

• Digital asset consulting and consulting.

• Services handle digital assets (exchanges).

Private tutoring courses for external parties who may be interested in the company (Cryptocurrency Course, Blockchain, Smart Contracts, Digital Asset Trading).

Fake model:

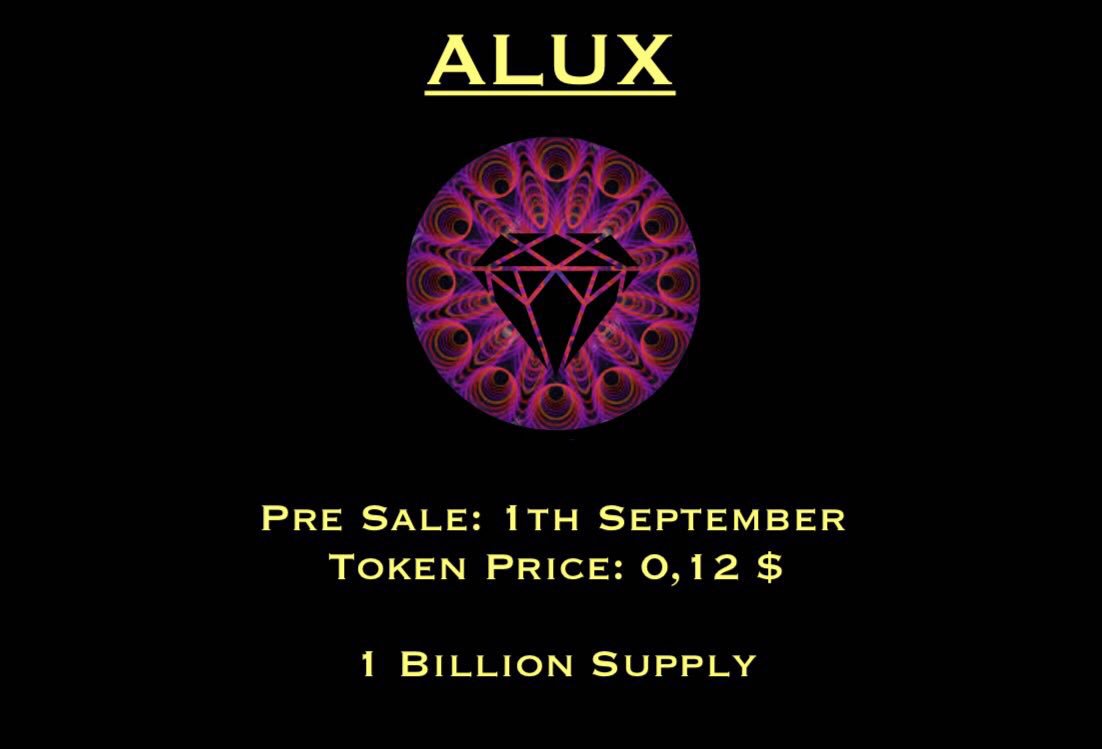

We have created Alux development with a bid of one billion tokens for the purpose, and officially provide the company with liquidity to achieve our goal intent. In the same vein, the token sales dikutip.Pembeli token, the company recognized the quality as a partner, he will be negotiated after the pre-sale period, some exchange rates, which should justify the web to exercise their rights to the partners and especially the collection of dividends, Certifications that meet all legal requirements of KYC and AML under the applicable state laws.

We can say that we are not the whole world to know how to manage this new technology, we learned through all sorts of teknologi.Karena, we entered the new era, the current generation was born, we can use It is important to be able to promote ourselves to a new financial system, and we can make mistakes because we continue to maintain the current financial system serius. An electric car that will take steps to understand that you can defend yourself. Some things do not work and can cause a lot of problems. So we think we should evolve with new technology at the same time.

By the date Digital Lux Ant (completed in the first round):

• Creation of a corporate constitution.

• Collaboration with external administrators.

• Web companies with access to users / clients.

• Token development and activation is created.

• Web token purchase module.

• Activate token sales.

• Trading Bot + IA

• Service management processes digital assets.

• Digital Asset Deposits Services.

• Consulting services and digital asset advisory.

• On-demand ATM manufacturing.

• Early Bounty Program.

"We have a customer portfolio from the very beginning of our company and all services are used by our community / customers."

Regulation EDE Constitution: The main task of Digital Lux Ant is defined as a project aiming to discover the capital required to manage all types of licenses and licenses in the jurisdiction that eventually need to have EDE. There is Electronic Money Entities in the middle, not banks or Fintech, but it has the ability to operate as a financial institution. This is done in a variety of ways of moving the bank with the required approval of today's activities. This is EDE

Position Competitive advantage further provides, at the moment, FINTECH is not authorized to perform the service "core and financial regulation".

Development of electronic financial platform:

We would like to provide electronic financial services for both companies.

It is a personal, autonomous company, offering the highest level of comfort and speed to record everyday care, making it more intensive, dynamic and professional. The most common tasks in banking system electronics range from transferring and transferring files or administrative logbooks to consulting such as receipt to account transfer.

Electronic finance will provide a valuable set of benefits,

We will add low-cost fees for operations that traditional banking does not offer, and will participate as a third co-op in the deal. At Digital Lux Ant we reduce service costs by implementing smart contracts that do not have intermediaries.

Published Payment Solutions:

Like other presentations, we have designed microcredit for both private and public, with advance study of customer qualifications for clients using intelligent contracts. This occurs to reduce the cost of the requested loan to ensure the convenience of convenience and the function of the quotation marks.

Based on these errors and business philosophy, we've proposed the following enhancements to attract the best customers as well as the best partners:

• Talent recruitment and retention: self-governing, various remuneration by commission of each employee according to company goals that achieve their goals each year, unlimited recruitment of profiles related to software development, and so on.

• 360º of communication: Experts at Lux Ant Digital should have extensive experience in their area and share, discuss and coordinate operational decisions appropriately.

Specialization: The target market should be familiar with Lux Ant Digital because of its high level of expertise in software development and digital financial management,

For most IT companies, this should be absolutely true.

• External corporate image: Consistent with this philosophy, there is a contrast that the usefulness of new technologies and computer development is a key factor in success when leading the sector.

Lux Ant Digital, design drawing to be printed

Once again, differentiation and modernity for the market through more and more corporate images.

We offer innovative phones. Reinvestment benefits are a priority goal for developing innovative product catalogs, and ensure that investments are made with invoices as much as possible.

Continuous evaluation

• Develops a focus on the entire team that seeks to achieve a commercial potential that has nothing to do with the core of the company.

• Strengthen your relationships with internationally competent partners.

• Improves brand image and brand positioning focused on attracting buyers without ignoring the seriousness of the images printed by technology companies (marketing, advertising and communications managers in the corporate finalists).

• Carry out aggressive competitive supervision of the system's financial evolution and digital asset regulation.

• Promote recruitment of recent graduates or recent graduates trained by highly experienced staff, taking into account the lack of technical freshness and professionalism.

• Special attention to finance and important monitoring. Evaluate the likelihood of an investor contributing financial manager in terms of increasing external funding.

Backup plan

We do business continuity management in this way to handle company capacity and maintenance. It is an important part of information system security management, has been planned, proven, and is now more commonly known as evolved career security. When we talk about business continuity we refer to "bad" viability. It can have a negative impact on the company.

Regulations and Obligations

EDE calls require a more robust technology platform than Fintech's compliance with security, money laundering and risk operating rules. And, on the other hand, with the approval of the required activities, a variety of mobile banking models can be run financially no matter which institution is currently performing. KYC & AML KYC & AML Regular enterprise Digital Lux Ant is committed to meeting all the essential and mandatory requirements for KYC regulations and AML to detect fraudulent use of money for suspicious activity. We understand KYC's process of monitoring and controlling new customers and former customers from new customer and previous customer donations and sayings to avoid commercial siding with people involved in crime such as money laundering, terrorism and corruption. I will. Government, and drug-related crimes. KYC responds to legal orders from financial institutions around the world.

On the one hand, we need to identify our customers by presenting identification cards, passports, NIEs and NIFs for foreign customers. And on the other hand, they have an obligation to participate in the main identification. In other words, it must be known at any time after the account establishment company. All of these requirements for new customers are outdated, so sometimes an entity client can request this information from someone else. If the customer declines submitting the required documentation from the bank, this service may be terminated and the bank account may be closed in accordance with the Google Privacy Policy and the Google Translate Community Terms and Conditions.

TOKEN ALANAN

Lux Ant has developed a digital contract digital token that is provided by the Digital SL Ethereum network. The token name is "Alux Digital" and the price is "ALUX". The token was authenticated and tested by the Ethereum standard developer. The tokens are managed like ethernet bags, and the company is aware of him as a quality partner and they are working with virtual coins, which means any move or terdaftar.Pembeli trading tokens, he is able to exercise his own rights

Dividend payments must be justified on the company web. Demonstrate compliance with all existing legal requirements KYC y AML Establish current legislation in seat operating countries

He is free to use the token membership as well as the third member, so that according to the requirements of the office, can request the contribution of the token in the online special web page, the need for prior communication with lainnya.Dengan intention of the capital to complete the token No, the shareholder can enumerate the proposed prices through forex trading, granting administrator privileges. If you feel that you need it, you are also authorized to hire services from Market Maker to avoid sudden or sudden movements at token prices.

Ownership & Interests

The manufacturing proposal of ALUX Token aims to provide liquidity to Lux Ant Digital and can fulfill its goal. In this way, the seller Alux token can be negotiated after the pre-sale period, some bursa.Pembeli tokens, the company to recognize him as a quality partner, and the company should justify its corporate Web, exercising its own rights, especially special dividends May be possible.

Demonstrate that the country that owns the company complies with all existing legal requirements.

• Project description: EDE development

• ALUX Description: Performs the required action with the token created by Lux Ant Digital.

Do not make the final project.

• Symbol Ticket: ALUX

Token History: Token ERC-20 from Ethereum's Blockchain

• Total number of tokens ALUX: 1 Billon token

• Unsold Token Transaction: Will be burned.

• Token ALUX Cryptocurrency : Ethereum & Bitcoin

Our view and the rest The lack of innovation in the field of financial heritage management in the society implies that we are in the past. The opportunity we have to offer is a part of the leader of the new digital era is so big and very useful for modernizing the technology semua.Akses that have ever successfully changed the ad

By significantly reducing costs and significantly increasing market share through digital acquisitions of customers,

Lux Digital Ant has integrated EDE (Electronic Money Agency) projects, which will focus on economies of scale, elimination of third-party fees, and providing basic financial services such as savings and loans. To achieve this goal, Lux Ant Digital requires additional banking, licensing and / or partnerships in the major jurisdictions to operate in trust money and to facilitate international transactions that do not require third party committees. Digital ants for business (cash flow) will also provide good service innovation for individual customers (saving) .Lux We have established a network of retailers that exist to maintain this service, Forget about cash. Agents networks and gas stations, cigarette sellers, etc. each have an account for Lux Ant Digital to facilitate these tasks and services. In addition, we have a payment card issued directly by the company, which can be used as an option for withdrawals and deposits from most ATMs available worldwide.

The ability to have deposit and loan problems is understood as the basis for anything.

However, the banking system knows that it is very difficult to access this sector, especially due to the compliance requirements at the capital. That's why Lux Ant Digital has a successful goal that has been previously analyzed in licensing and collaboration acquisitions - a way to do business forecasting without limit on the amount of initial capital.

Therefore, it is very important that Lux Ant Digital has access to the market with sufficient capital to enjoy economies of scale and to compete with existing markets. Today all investors are a.

Website: https://luxantdigitalbank.com/

Telegram: https://t.me/LUX_ANT_DIGITAL

Twitter: https://twitter.com/lux_ant

Facebook: https://www.facebook.com/ALUX.BANK/

Instagram : https://www.instagram.com/luxantdigital/

Author by: Ayin2206

Comments

Post a Comment